19.04.2024

5 perfect post-marathon mews for a relaxed stroll

This Sunday, our incredible office manager, Laura Rogers, will be lacing up her running shoes and hitting the streets of London for a remarkable cause. She’s running the London Marathon to support Lung + Asthma UK, a cause close to her heart and we couldn’t be prouder of her dedication and determination! The London Marathon […]

17.04.2024

Mews in Bloom Competition 2024

Lurot Brand's annual Mews in Bloom Competition is approaching! Keep an eye out for an enticing prize announcement and details of our distinguished judges. Join us in our competition aimed at inspiring mews residents to spruce up their courtyards and show off their green fingers!

21.08.2023

One-to-one with Frederick Hampton

About buying not one, but two derelict houses 45 years ago in Junction Mews, Hyde Park & spotting the potential ahead of the trend for mews homes.

Featured News

Discover the Charming Beauty and Rich History of Kynance Mews in London’s South Kensington

Featured News

01.02.2023

LB Loves… Notting Hill

It’s fun, it’s full of energy, and its perfect for festive treats, catching up, celebrating Christmas and chilling as you shop for that special present. What’s not to like about Notting Hill? It’s our ‘go-to’ place, so here are some of the season’s favourites for your ‘to-do’ list this year.

27.01.2023

Six Bedrooms to Dream About this Winter

You've had a hectic festive season, the nights are long and that January slump is well into it's maturity. Many people accross London choose to spend more time in bed hiding away from these cold and rainy winter months.

25.01.2023

Ten Mews to Explore this Month

London is a city known for its rich history, culture, and architecture. One of the most iconic features of the city are its mews, which are small streets or alleys that were originally used to house horses and carriages.

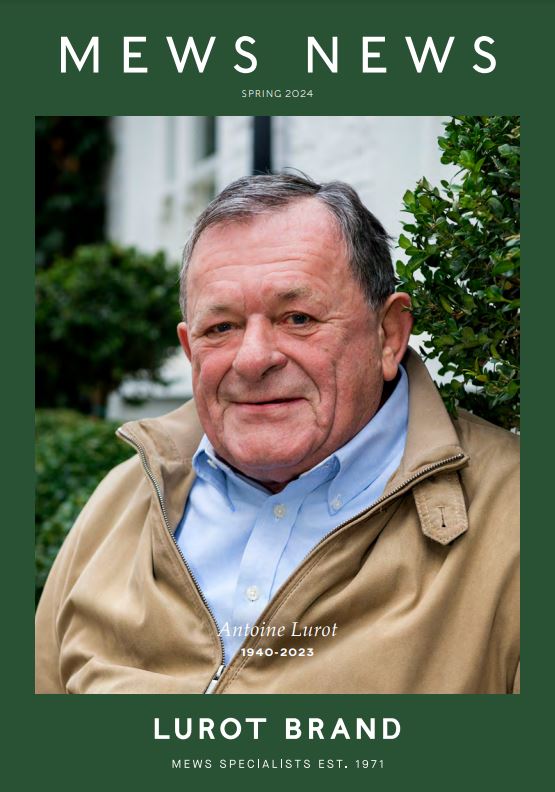

Mews News Spring 2024 — Out Now

As Spring begins to make its presence felt, the iconic mews streets of London are starting to bloom, with hints of blossom adorning their flower-covered walls and surrounding courtyard trees. This Spring edition of Mews News holds special significance as we honour our founder, Antoine Lurot. In this issue, we reflect on his legacy and share insights into the company's future direction. Kati, our co-founder and Lurot Brand director, shares heartfelt words about navigating this period of transition. Additionally, Head of Sales Billy Harvey and Director & Head of Lettings Mollie Swallow provide valuable updates on the monthly prime market snapshots, offering a comprehensive overview of the property market. We delve into the fascinating evolution of mews interior design, tracing its journey from the Georgian period to the present day and our mews experts also offer their recommendations in Pavilion Road Chelsea, including must-visit cheesemongers and expert coffee connoisseurs. With our latest selection of exquisite mews homes for sale and rent, immerse yourself in the pages of Mews News, whether in print or digital format, and discover the hidden gems of London’s vibrant mews cultures this season.

READ THE LATEST ISSUE

Featured News

Understanding Mews Arches

Interviews

Interviews

News Categories

Subscribe

We'd love to share latest mews news and regular updates with you