London Property Investment: Why A Mews Is A Good Investment

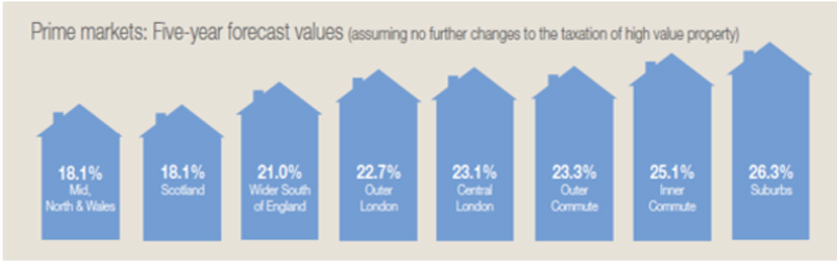

The Savils 5 year forecast for the UK residential market would indicate that prime real estate in London is a good future investment as far as property price increases are concerned. Whilst the London property bubble has created a significant gap in house prices growth in the capital is set to increase exponentially.

Residential property focus Q1 2014: Savils World Research: UK residential market February 2014

Whilst the property value of prime residential locations [such as our Mews properties ] is set to increase, the hot topic of the moment is whether or not parliament will push through residential taxation on high value properties ahead of the 2015 elections. Moving this to one side however house prices in prime residential locations in central London will rise by 23.1% in the next 5 years. If we also factor in the relatively low transaction costs in the UK, prime residential properties is an area of investment worth its weight in gold.

A report to the FPC [Bank of England] has good news for the housing sector. With improved credit conditions and accelerating recovery in the wider economy. These and also employment generally rising, will lead to UK house prices growing by as much as 8.4% this year. Prices will then increase by 6.5% annually thereafter. In which case there might be little cause for concern. Dean Hodcroft, Head of Real Estate & Construction, EY goes further to say:

“From Mayfair to Belgravia, and parts of St Johns Wood and Marylebone – will not be a bubble that bursts anytime soon, given the continuing interest from international cash buyers and the seemingly irresistible global draw of London’s ‘X-factor’.”

The quote above is from their recent report “UK Housing: No Bubble To Burst Except In London”. This makes for some interesting reading for the discerning investor looking at the UK property market; in that whilst policy makers are looking at measures to cool of the exponential rise of the London price bubble, the above statement is likely to hold true. With such increases in the UK market our advice would be to invest in prime real estate in London locations.